World fiber consumption has increased over several decades; from 1950 to 2008, the per capita consumption increased from 3.7 kg to 10.4 kg, and through continuous development, it recorded in 2014 a demand of 55.2 million tons (122 billion pounds) of synthetic fibers, in addition to the natural fibers, including cotton and wool, which have a demand of 25.4 million tons.

Polyester fiber has become the fiber of choice within the textile industry, because of its physical properties, price, recyclability, and versatility, which offer a unique set of advantages unmatched by any other fiber. Since 1990, the consumption of polyester fibers has grown at a sustained rate of nearly 7% per year globally. The polyester fiber market has grown to such an extent that it represents half of the total global fiber market (man-made and natural fibers). In 2019, total consumption of polyester fibers was dominated by polyester yarn, with textile filaments having the greatest share of the yarn segment.

The main application of polyester fibers is in the production of fabrics, which are used for the manufacture of apparel, garments, and other finished textile goods. Home furnishings constitute the second-largest end-use sector globally. Most of the demand is now in Asia (mainland China, India, and Viet Nam), where the fast-growing textile industry has been consuming increasing amounts of polyester fibers in a chain of textile weaving, dyeing, and apparel-making industries.

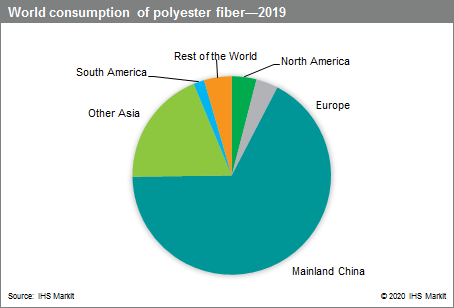

The following pie chart shows world consumption of polyester fibers:

Polyester fiber is the single-largest-volume fiber used globally, accounting for about 50% of the overall man-made and natural fiber market. Since 2000, the consumption of polyester fibers has grown at a sustained rate because of their low cost of production as well as their versatility and a relatively large spectrum of applications (from heavy-duty industrial applications to consumer apparel and home furnishing products). The substitution for other materials has allowed polyester fiber to grow faster than the fiber market itself.

The main competing fiber for polyester is cotton; as a result, the supply and demand balance within the cotton industry affects the polyester fiber industry. In 2010 and early 2011 for instance, peak cotton prices resulting from global supply shortages and low stock levels boosted demand for polyester fibers. Barriers to entry are relatively low in the polyester fiber industry and the producer landscape is, therefore, extremely fragmented. Mainland China alone has more than 900 producing units. Most polyester fiber producers are back-integrated into PET polymer production and, therefore, run a continuous polymerization line upstream.

Over the years, the production of polyester fiber has migrated to Asia, which now accounts for the majority of capacity. Most polyester fiber consumption has also migrated to Asia, where the fast-growing textile industry has been consuming increasing amounts of the product. Mainland China is by far the largest consumer of polyester fibers and exports large amounts of finished goods—including apparel, curtains, and bedding—around the world. The recent trade tensions between the United States and mainland China, as well as anti-dumping measures taken by the United States against some grades of polyester fibers deriving from specific countries, are expected to further reshape the list of fiber suppliers to North America. There are already short-term implications anticipated in the US market, for which this report provides specific insight.

The use of R-PET for the production of some specific polyester fiber grade has increased over the years but the recently implemented waste import ban in mainland China has changed the dynamics of R-PET usage. This trend has had key implications for the market and this is further studied in this report.

Northeast Asia is expected to remain the leading actor on the global polyester fiber stage over the foreseeable future, further pursuing new investments. Nevertheless, as Chinese wages are slowly increasing, a gradual shift of textile production toward other less-advanced but developing Asian nations is expected to intensify in the longer run, which will partially limit polyester fiber demand growth in mainland China; nevertheless the failed attempt to implement the TransPacific Partnership in its entirety will have implications in the pace of development of the fiber industry in specific countries. The Indian Subcontinent will retain its position as the second-largest producing region, and Southeast Asia, capitalizing on its still-low labor costs, will pursue growth in the market and remain the third-largest producer globally.

During 2019–24, the market for polyester fibers is expected to grow further, at an average rate of about 4% per year. Asia will remain the focal point of this growth as it will remain the manufacturing center for textiles, clothing, and apparel globally. In all other regions, the polyester fiber market will continue to grow slowly, particularly in segments that are less affected by inexpensive imports from Asia, such as tire cord or nonwoven fabrics. Textile filaments will remain the fastest-growing product because of the increasing textile requirements in the emerging world. For more detailed information, see IHS Markit’s Chemical Economics Handbook

Fibers and materials Change Insight in the Textile Industry 2019 during Covid 19 Pandemic

Textile Exchange announces the launch of its 2019 Material Change Insights Report, which surfaces valuable insights about the state of fiber and materials sourcing in the textiles sector in the context of the COVID-19 pandemic.

The report draws on exclusive data provided through Textile Exchange’s Corporate Fiber & Materials Benchmark (CFMB) program, the largest peer-to-peer comparison initiative in the textiles sector with more than 170 voluntary brand participants. The CFMB program fills a necessary industry gap by rigorously analyzing self-reported company data to track the materials sourcing progress of individual companies as well as the industry at large.

The resulting Material Change Insights Report provides one of the most data-backed and comprehensive analyses of how the industry is progressing in its shift to preferred materials, as well as alignment with global efforts like the Sustainable Development Goals (SDGs) and the transition to a circular economy. It builds on Textile Exchange’s Material Change Index (MCI) — a family of indices, published earlier in the year, that tracks individual company progress.

Key 2019 Report Insights

The 2019 Material Change Insights Report is based on companies’ self-reported data from 2018. Key findings include:

- Reporting companies sourced nearly 40% of their materials from preferred sources in 2018.

- Reporting companies collectively converted 1.7 million metric tons of materials to preferred in 2018, resulting in a saving of 1 million metric tons of greenhouse gases.

- Sweden is leading the race to the top, with 12 Swedish headquartered companies accounting for 40% of the preferred materials reported.

- 66% of companies said they have started aligning their business strategy with the SDGs. However, 71% have not set measurable targets within their Goal alignment.

- 86% of companies responding to the circularity module have a circularity strategy — but coverage and investment are still very limited. For example, only ~0.06% of reported recycled materials come from post-consumer textile waste.

Source from PRWEB.com

World Polyester Fibers Market 2020 To 2027

We introduce you to this link below to know more about the world polyester fiber market from 2020.

Global” Polyester Fiber” Market report exhibits a pin-point breakdown of Industry dependent on the type, applications, and research. Development methodologies involved by these organizations are research in detail in the report.

The market size region gives the Polyester Fiber market incomes, covering both the historic growth of the market and forecast during 2027.

The Polyester Fiber Market report also focuses on some of the key growth prospects, including new product launches, MandA, RandD, joint ventures, collaborations, agreements, partnerships, and Polyester Fiber market growth of the key players functioning in the market, both in terms of regional and global scale. Analysts forecast the Global Polyester Fiber market to grow at the highest CAGR during the forecast period 2020-2027.

To read more, please see https://www.databridgemarketresearch.com/reports/global-polyester-fibre-market#

We take no responsibility for any of the content found on the linked website or for any improper or incorrect use of the information or services on the linked Website and assume no responsibility for anyone’s use of the information or services.